CREDIT INACCURACIES RUINING

YOUR CREDIT SCORE?

use this secret hack to Join The Top 1% Of people with great credit scores because they leverage the laws to keep their credit reports clean from errors

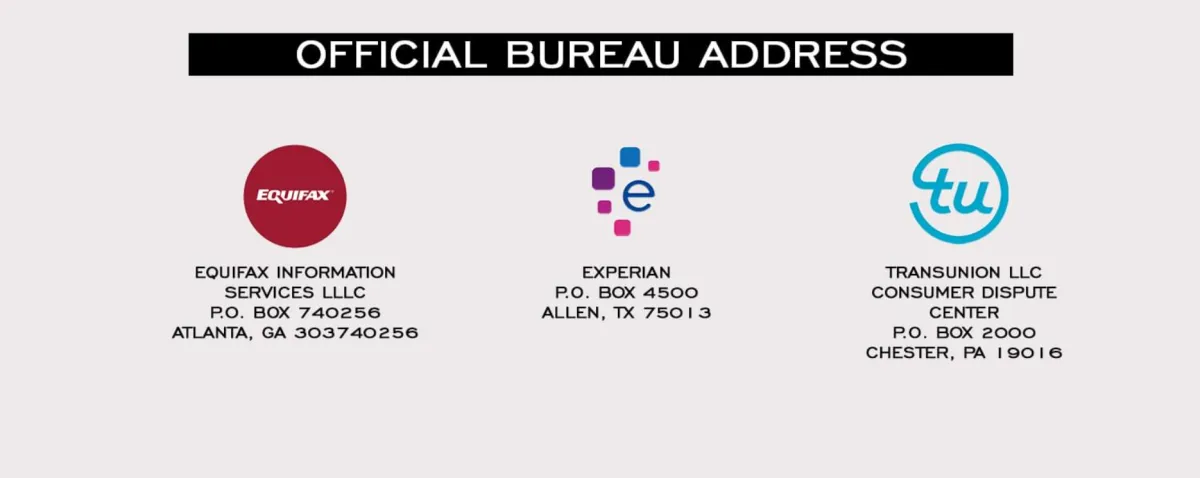

Whenever sending letters to the credit bureaus, be sure to use these addresses.

Remember to always save your receipts and place them in a folder along with the rest of your paperwork that you will be using while disputing items on your credit report.

Check Out Some Of Our Past Results That We Have Gotten For Some Of Our Clients!

Copyright - All rights reserved

PRIVACY POLICY | TERMS OF SERVICE

This site is not a part of the YouTube, Google or Facebook website; Google Inc or Facebook Inc. Additionally, This site is NOT endorsed by YouTube, Google or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc.

In the nature of transparency and authenticity, we do have paid programs. Is it required? Absolutely not. Some people will see what's possible, and know that working together is just what they need to get results even faster.

DISCLAIMER: Any results discussed are our personal results and in some cases the results of previous or existing clients. Please understand these results are not typical. We’re not implying you’ll duplicate them (or do anything for that matter). Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, we are not a right fit to work together.

Consumers have the right to receive their Credit Report from either one, or the three nationwide consumer reporting agencies once every 12 calendar months.

By using this software, you understand that this software will not generate a credit score.

This software is not a credit repair service organization. In addition, this software does not express in any way to fix the credit of it's users.

Consumers have a right to dispute inaccurate information on their credit report by contacting each of the credit bureaus directly. However, neither you nor a credit repair company or credit repair organization has the right to have accurate, current and verifiable information removed from your credit report. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported up to 10 years. Credit bureaus are required to follow reasonable procedures to ensure that the information they report is accurate. However, mistakes may occur.

You may, on your own, notify a credit bureau in writing that you dispute that accuracy of information in your credit file. The credit bureau must then reinvestigate and modify or remove inaccurate or incomplete information. The credit bureau may not charge any fee for this service. Any pertinent information and copies of all documents you have concerning an error should be given to the credit bureau.

If the credit bureau's reinvestigation does not resolve the dispute to your satisfaction, you may send a brief statement to the credit bureau to be kept in your file, explaining why you think the record is inaccurate. The credit bureau must include a summary of your statement about disputed information with any report it issues about you.